Hungary's enchanting landscapes, rich history, and vibrant culture have not only drawn filmmakers seeking captivating backdrops but have also positioned the country as a beacon for the global film industry. At the heart of Hungary's appeal lies the Film Production Tax Incentive, a strategic initiative designed to fuel the cinematic ambitions of both local and international filmmakers.

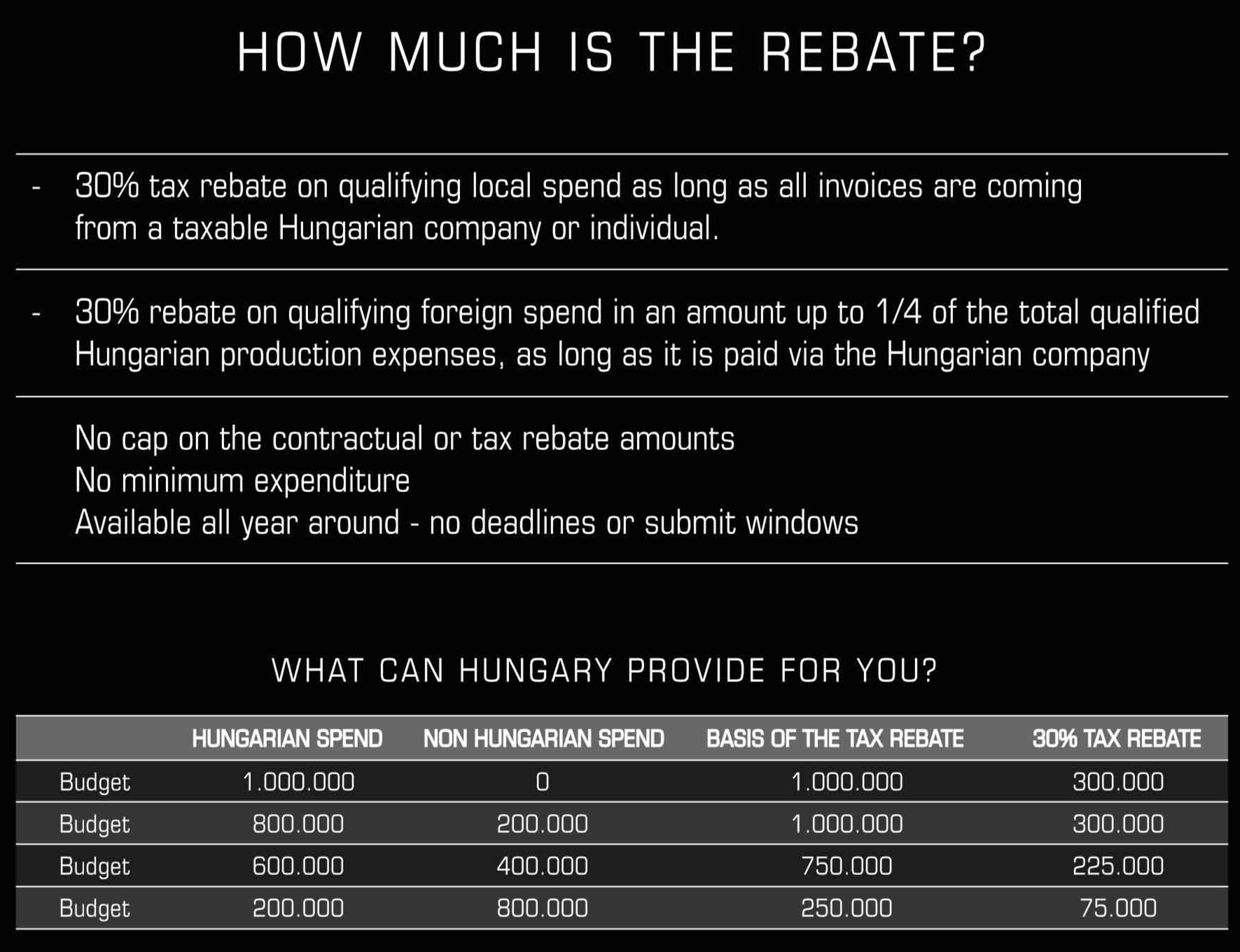

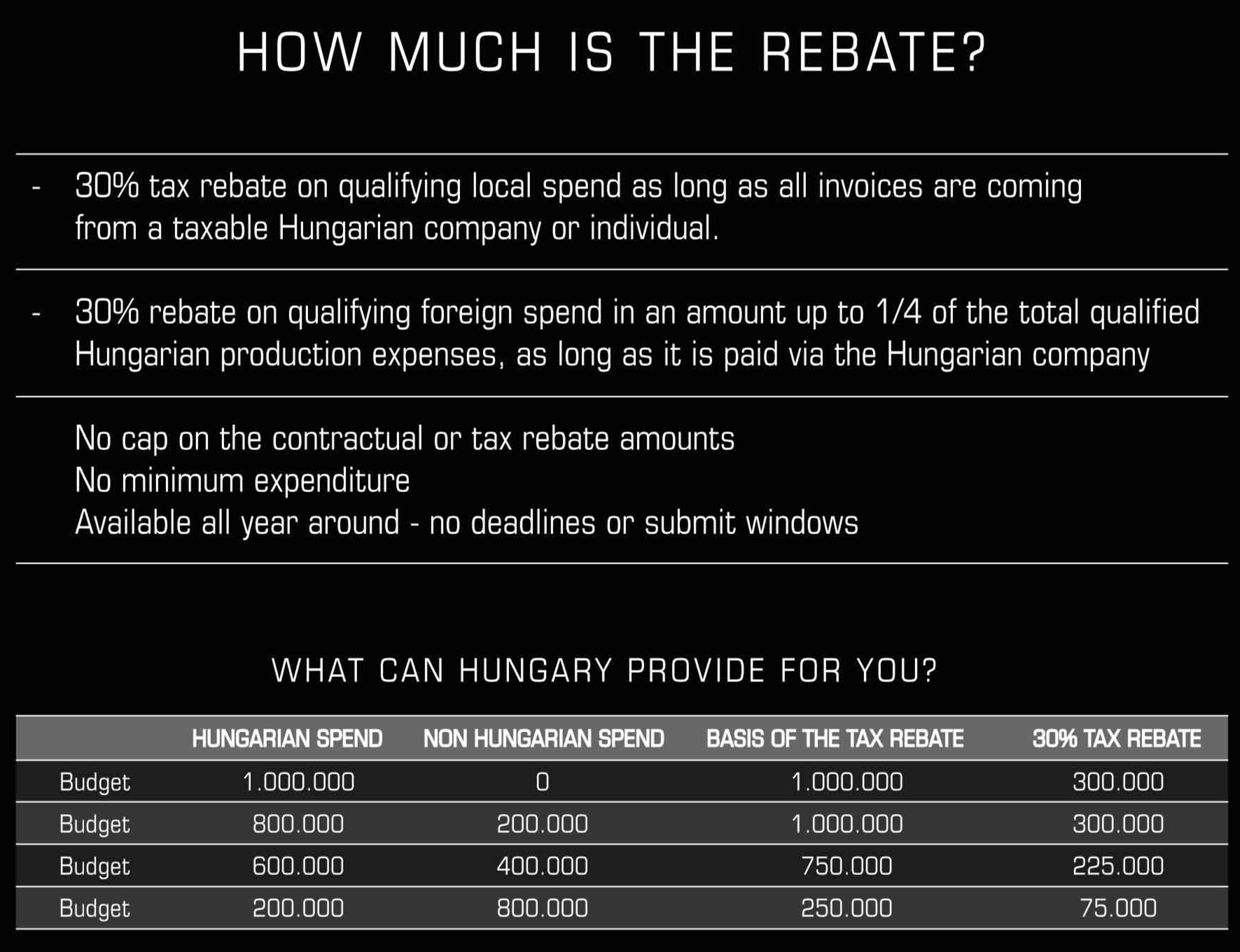

1. 30% Tax Incentive on Qualifying Spend:

The cornerstone of Hungary's Film Production Tax Incentive is the generous 30% tax incentive on qualifying expenditures. This incentive applies to both local and foreign spend, making it a powerful financial incentive for filmmakers choosing Hungary as their production location.

2. Flexibility for Local and Foreign Productions:

The incentive extends its benefits to both local and international productions. For local spend, all invoices must originate from taxable Hungarian entities, ensuring that the benefits contribute to the domestic film industry. Simultaneously, foreign productions can leverage the incentive by channeling qualifying expenditures through a Hungarian company.

3. No Cap or Minimum Expenditure:

Uniquely, Hungary's Film Production Tax Incentive places no cap on contractual or tax incentive amounts. Filmmakers are not constrained by limitations, allowing for ambitious and large-scale productions to fully benefit from the substantial incentive. Moreover, there is no minimum expenditure requirement, fostering accessibility for projects of varying scales.

4. Year-Round Availability:

Hungary's commitment to supporting the film industry is reflected in the year-round availability of the Film Production Tax Incentive. Unlike programs with specific submission windows, Hungary's approach ensures that filmmakers can apply for the incentive at any time, providing flexibility and accessibility.

5. Qualifying Expenditure Categories:

The incentive covers a comprehensive array of expenditure categories, both locally and abroad. Local spend includes wages, rental costs, set construction, purchases, materials, consumables, travel, accommodation, catering, and certain financing and administration costs. Foreign spend encompasses shooting costs, post-production, rental costs, non-Hungarian bonds, insurance, legal fees, and non-Hungarian producer fees.

6. Global Collaboration and Talent:

Recognizing the global nature of filmmaking, Hungary's Film Production Tax Incentive accommodates foreign cast and crew working within the country. Tax residency, not nationality, is the key determinant, emphasizing Hungary's openness to international talent contributing to the local film industry.

7. Transparent Application Process:

Filmmakers seeking to harness the benefits of the incentive will find a transparent and streamlined application process. Submission of documentation supporting eligible expenditures is followed by a review process, ensuring that the financial incentives reach filmmakers efficiently.

8. Contributing to Hungary's Cinematic Legacy:

Beyond the immediate financial benefits, the Film Production Tax Incentive significantly contributes to Hungary's cinematic legacy. The country has witnessed a surge in film productions, both local and international, enriching its cultural tapestry and elevating its standing in the global film landscape.

In essence, Hungary's Film Production Tax Incentive is a testament to the government's commitment to nurturing creativity, encouraging economic growth, and fostering international collaborations. Filmmakers from around the world continue to choose Hungary not only for its enchanting locations but also for the unparalleled fiscal support that transforms cinematic visions into captivating realities on the silver screen.

1. 30% Tax Incentive on Qualifying Spend:

The cornerstone of Hungary's Film Production Tax Incentive is the generous 30% tax incentive on qualifying expenditures. This incentive applies to both local and foreign spend, making it a powerful financial incentive for filmmakers choosing Hungary as their production location.

2. Flexibility for Local and Foreign Productions:

The incentive extends its benefits to both local and international productions. For local spend, all invoices must originate from taxable Hungarian entities, ensuring that the benefits contribute to the domestic film industry. Simultaneously, foreign productions can leverage the incentive by channeling qualifying expenditures through a Hungarian company.

3. No Cap or Minimum Expenditure:

Uniquely, Hungary's Film Production Tax Incentive places no cap on contractual or tax incentive amounts. Filmmakers are not constrained by limitations, allowing for ambitious and large-scale productions to fully benefit from the substantial incentive. Moreover, there is no minimum expenditure requirement, fostering accessibility for projects of varying scales.

4. Year-Round Availability:

Hungary's commitment to supporting the film industry is reflected in the year-round availability of the Film Production Tax Incentive. Unlike programs with specific submission windows, Hungary's approach ensures that filmmakers can apply for the incentive at any time, providing flexibility and accessibility.

5. Qualifying Expenditure Categories:

The incentive covers a comprehensive array of expenditure categories, both locally and abroad. Local spend includes wages, rental costs, set construction, purchases, materials, consumables, travel, accommodation, catering, and certain financing and administration costs. Foreign spend encompasses shooting costs, post-production, rental costs, non-Hungarian bonds, insurance, legal fees, and non-Hungarian producer fees.

6. Global Collaboration and Talent:

Recognizing the global nature of filmmaking, Hungary's Film Production Tax Incentive accommodates foreign cast and crew working within the country. Tax residency, not nationality, is the key determinant, emphasizing Hungary's openness to international talent contributing to the local film industry.

7. Transparent Application Process:

Filmmakers seeking to harness the benefits of the incentive will find a transparent and streamlined application process. Submission of documentation supporting eligible expenditures is followed by a review process, ensuring that the financial incentives reach filmmakers efficiently.

8. Contributing to Hungary's Cinematic Legacy:

Beyond the immediate financial benefits, the Film Production Tax Incentive significantly contributes to Hungary's cinematic legacy. The country has witnessed a surge in film productions, both local and international, enriching its cultural tapestry and elevating its standing in the global film landscape.

In essence, Hungary's Film Production Tax Incentive is a testament to the government's commitment to nurturing creativity, encouraging economic growth, and fostering international collaborations. Filmmakers from around the world continue to choose Hungary not only for its enchanting locations but also for the unparalleled fiscal support that transforms cinematic visions into captivating realities on the silver screen.